An Economic Downturn Does Not Necessarily Lead to a Real Estate Crisis.

Everywhere you look there is talk of a possible recession. And if you’re planning to buy or sell a home, you may be wondering if that plan is still a smart choice. To reassure you, experts say that even if we officially enter a recession, the recession will be mild and short. At its March meeting, the Fed explained:

“. . . the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

While a recession may be on the horizon, it won’t be one for the housing market record books like the crash in 2008. What we have to remember is that a recession doesn’t always lead to a housing crisis.

To prove it, let’s look at the historical data of what happened in real estate during previous recessions. That way you know why you shouldn’t be afraid of what a recession could mean for the housing market today.

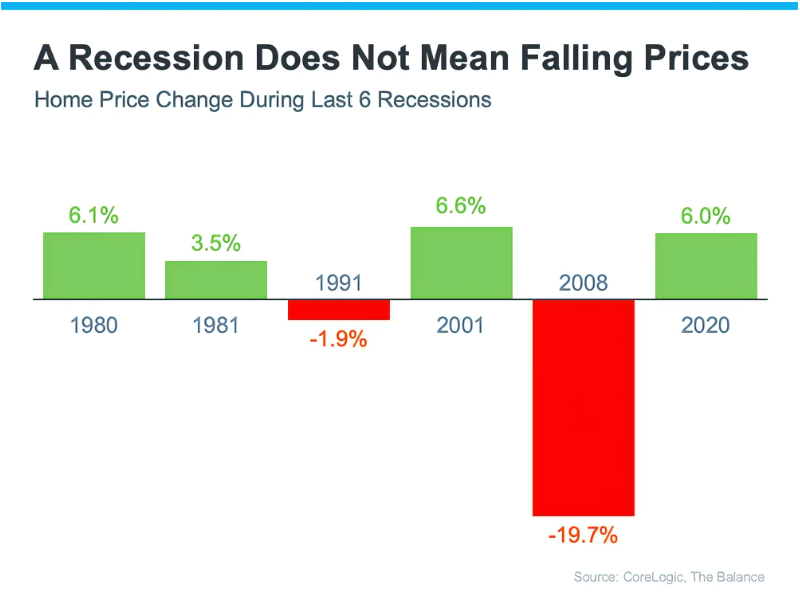

A recession doesn’t mean home prices are going down

To show that house prices don’t fall every recession, it’s helpful to look at historical data. As the chart below shows, house prices have risen in four of the last six recessions since 1980. Historically, therefore, slowing economies have not necessarily led to lower property values.

Most people remember the 2008 housing crisis (the larger of the two red bars in the chart above) and believe that when another recession hits, it will be a repeat of what happened to the housing market then. However, today’s real estate market will not collapse because the market fundamentals are different than he was in 2008. At the time, one of the main reasons for the price drop was the excess of homes being sold at the same time. The real estate market was in dire straits. There are now fewer homes for sale. House prices could fall slightly in some areas and rise slightly in others, but no crash is expected.

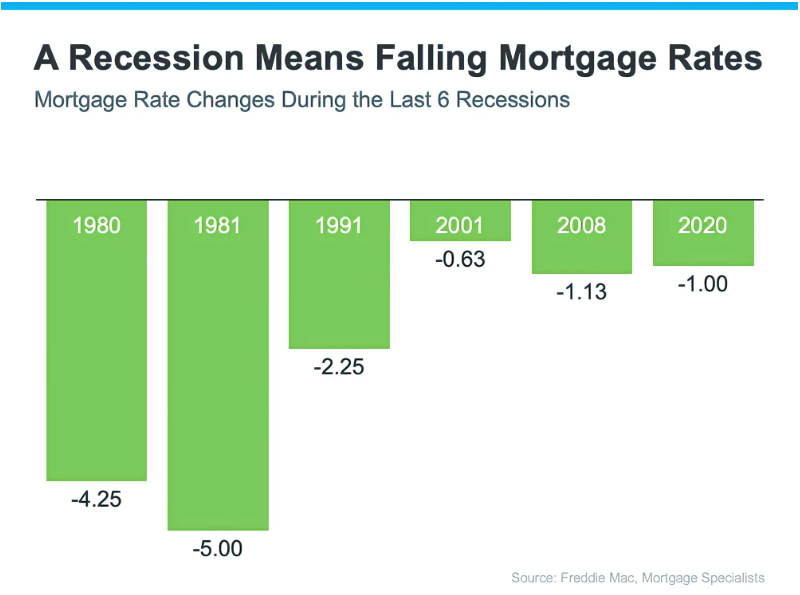

A Recession Means Falling Mortgage Rates

What a recession really means for the housing market is lower mortgage rates. As the chart below shows, mortgage rates have historically fallen each time the economy slowed.

Bankrate explains mortgage rates typically fall during an economic slowdown:

“During a traditional recession, the Fed will usually lower interest rates. This creates an incentive for people to spend money and stimulate the economy. It also typically leads to more affordable mortgage rates, which leads to more opportunity for homebuyers.”

Mortgage rates have fluctuated considerably this year in response to high inflation. 30-year fixed-rate mortgage rates fluctuate between about 6% and 7%, impacting affordability for many potential homebuyers.

However, history has shown that if a real recession hits, mortgage rates can drop below that benchmark even after the 3% days have passed.