What are today’s mortgage rates?

The average 30-year fixed mortgage rate rose to 3.88% from 3.77% a week ago. The 15-year fixed mortgage rate rose to 3.13% from 2.96% from a week ago.

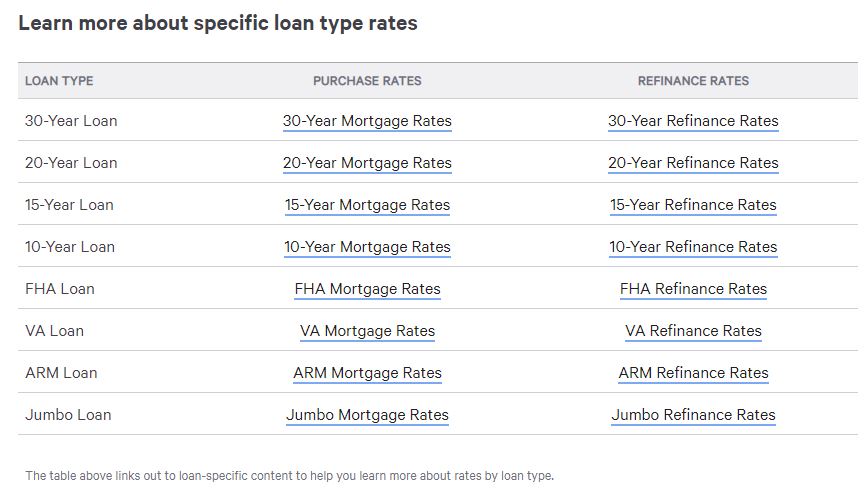

Additional mortgage rates can be found in the chart and graph below.

What is a mortgage interest rate?

Lenders charge interest on a mortgage as a cost of lending you money. Your mortgage interest rate determines the amount of interest you pay, along with the principal, or loan balance, for the term of your mortgage.

Mortgage interest rates determine your monthly payments over the life of the loan. Even a slight difference in rates can drive your monthly payments up or down, and you could pay thousands of dollars more or less in interest over the loan’s term. Knowing how interest rates factor into your loan pricing, as well as what goes into determining your rate, will help you evaluate lender estimates with more precision.

What factors determine my mortgage rate?

Lenders consider several items when pricing your interest rate:

- Credit score

- Down payment

- Property location

- Loan amount/closing costs

- Loan type

- Loan term

- Interest rate type

For starters, your credit score impacts your mortgage rate because it’s a measure of how likely you are to repay the loan on time. The higher your score, the less risk you pose so you’ll receive lower rates. You can check your credit score for free on Bankrate.

Lenders also look at your down payment amount. For example, if you bring a 20 percent down payment to the table, you’re seen as a less risky borrower and you’ll nab a lower rate than someone who’s financing most of their home purchase, which puts more of a lender’s money on the line if you were to default. (That’s also why lenders require you to pay private mortgage insurance with less than 20 percent down.)

The loan amount and closing costs also play a role in your mortgage rate. If you ask a lender to roll your closing costs and other borrowing fees into your loan, for example, you’ll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers may also pay higher rates for loans that are above or below the limits for conforming mortgages, depending on the lender’s guidelines.

Rates also depend on the type of mortgage you choose, the loan term and the interest type. You’ll pay much lower interest rates for shorter-term loans than longer-term loans because you’re paying off the mortgage faster. Adjustable-rate mortgages come with lower initial rates than their fixed-rate counterparts, but when the loan resets, rates can fluctuate with the market for the remainder of the loan term.

Use a mortgage calculator to plug in interest rates, your down payment, loan amount and loan term to get an idea of your monthly mortgage payments and other loan details.

What is the best credit score to get a mortgage?

An excellent credit score of 760 or higher generally will help you qualify for the most competitive rates offered by the mortgage lender. However, you don’t need excellent credit to qualify for a mortgage. Loans insured by the Federal Housing Administration, or FHA, have a minimum credit score requirement of 580.

Ideally, you want to work on your credit (if you have a lower score) to get the best loan offers possible. While you can get a mortgage with poor or bad credit, your interest rate and terms may not be as favorable.

What is the APR on a mortgage?

The APR, or annual percentage rate, on a mortgage reflects the interest rate as well as other borrowing costs, such as broker fees, discount points, private mortgage insurance, and some closing costs. The APR is expressed as a percentage and is usually a better indicator of your true borrowing costs than current mortgage rates alone.

How do I get the best mortgage rate?

To get the best mortgage rate, shop around with multiple lenders. Ideally, you want a rate that’s at least equal to, or better yet below, the current average rate for the loan product you’re interested in. Comparing rates from three, four or more lenders helps ensure you’re getting competitive offers on a new mortgage or a refinance. Inquire with large banks, credit unions, online lenders, regional banks, direct lenders and a mortgage broker to shop for a mortgage.

If lenders know they have to compete for your business, they might be more inclined to scrap certain fees or provide better terms. Additionally, you want to be comfortable with the mortgage process, and working with a reputable lender who is attentive and service-oriented will make the process go more smoothly.

You also want to compare loan fees, terms and offerings. Keep in mind that current mortgage rates change daily, even hourly. Rates move with market conditions and can vary by loan type and term. To ensure you’re getting accurate current mortgage rates, make sure you’re comparing similar loan estimates based on the precise term and product.

To learn more, visit our page and website, like, subscribe, and share. You can also contact us.

Website: www.CoutureRealtyLV.com

Email: Ken@CoutureRealtyLV.com

Phone: 702 – 476 – 0060

Facebook Page: Ken Couture Realty Your Home Sold Guaranteed